The new standard in online payments has officially reached Recharge. For US customers, Recharge now supports Apple Pay for mobile checkouts in conjunction with Stripe as a payment processor.

This new feature will allow subscription customers to pay for their orders on mobile in less time and with fewer steps, thus helping reduce friction during checkout.

Advantages to Apple Pay for subscriptions

Data shows that friction during the checkout process is one of the main sources of cart abandonment in the realm of ecommerce.

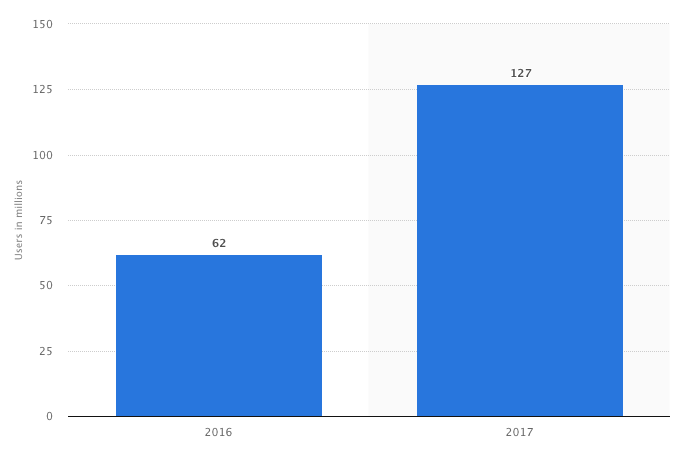

The good news: Digital wallets like Apple Pay help cut down on time and steps within the checkout phase of a customer journey, thus leading to more completed purchases and lower digital shopping cart abandonment rates—especially for mobile shoppers. In fact, Apple Pay tripled its user base in the first two years and transaction volumes are up 500%.

Now you can introduce this payment tool and reap those same benefits for your subscription-based business.

What is Apple Pay?

Apple Pay is a fast, simple, and secure digital payment tool that allows users to pay for goods and services via Apple devices (like an Apple Watch, iPhone, or iPad.) Using Apple Pay, you can make secure purchases in apps or on the web—and you can use it to send and receive money from friends and family as well. There’s no app to download, and you can use the cards you already have in your wallet.

How it works

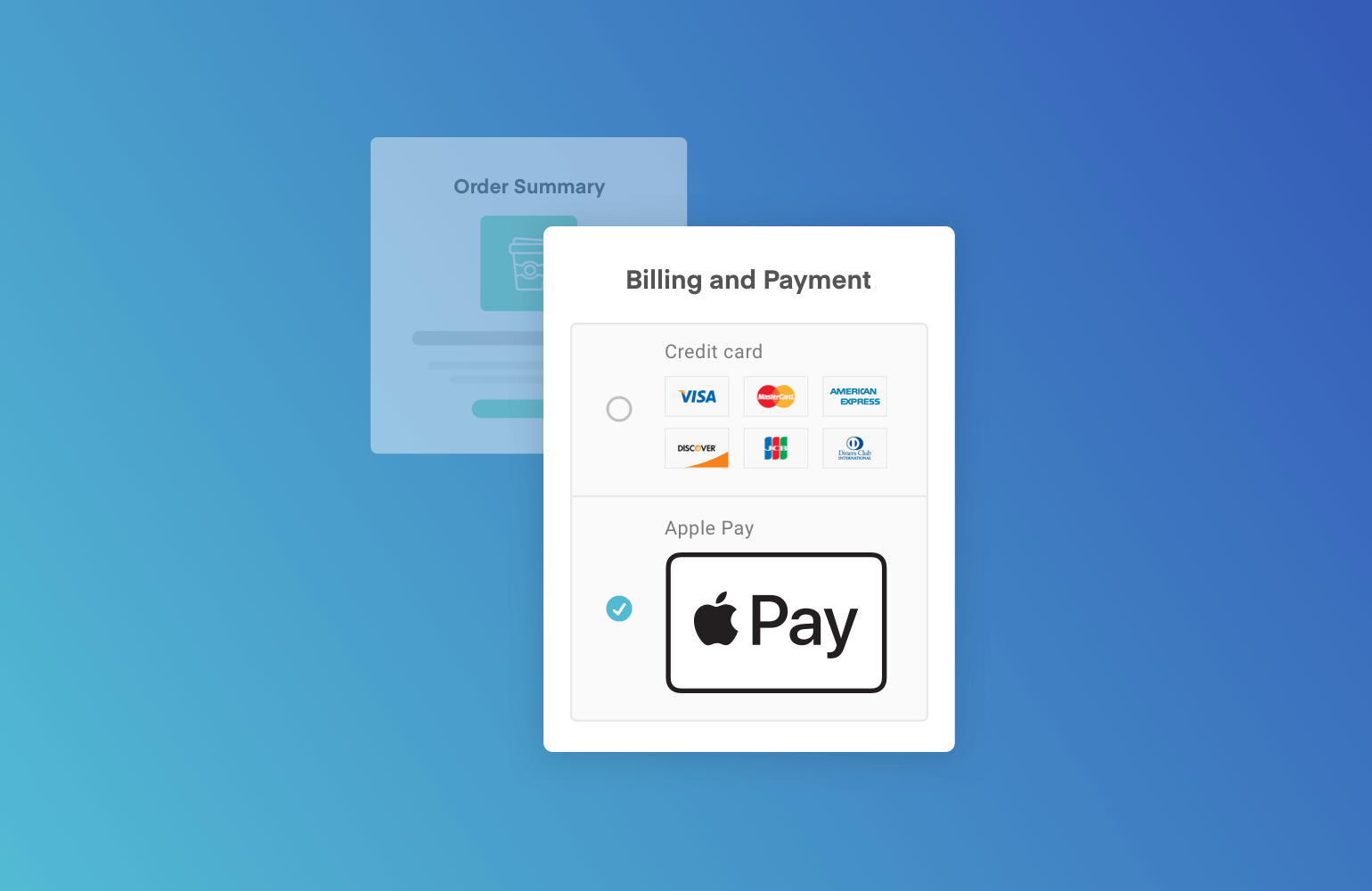

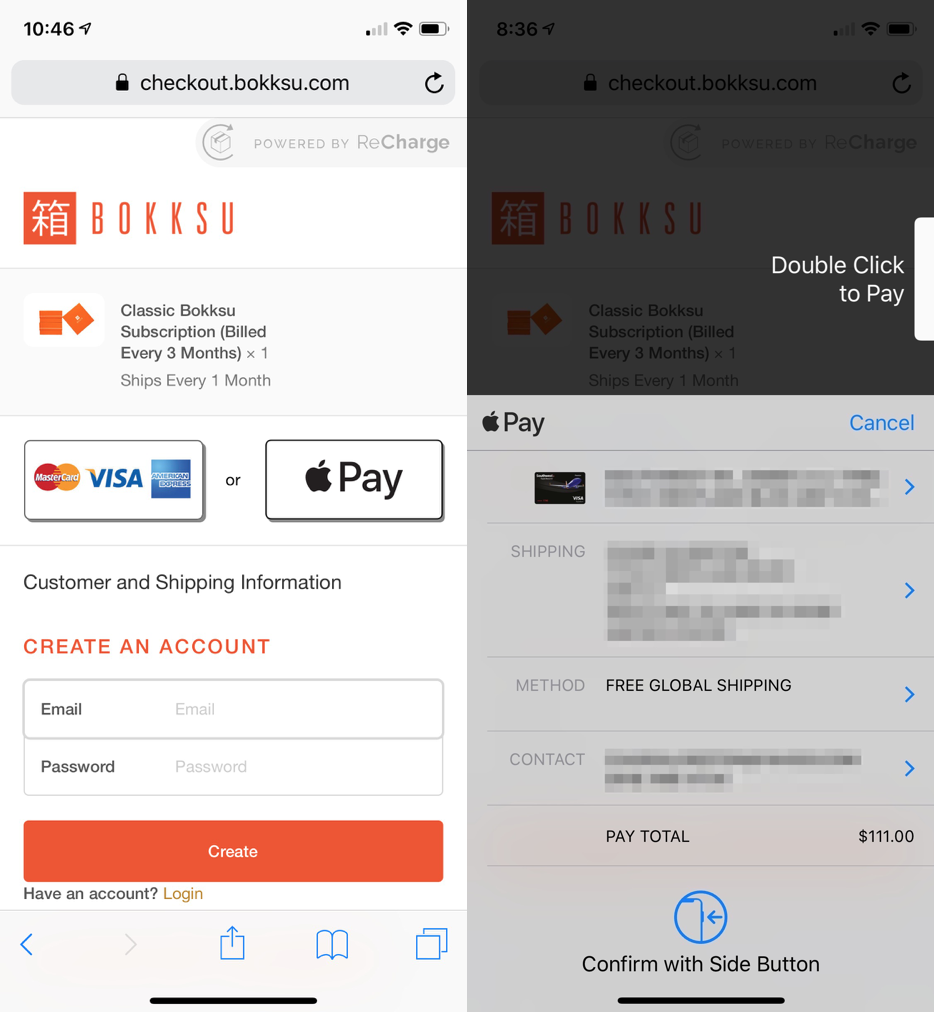

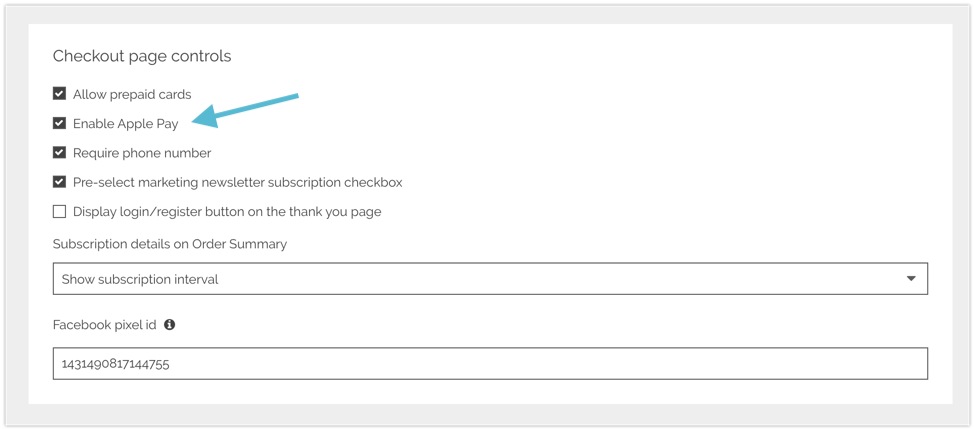

Once Recharge detects that you’re using Stripe for payment processing, you’ll see the option to enable Apple Pay in the Checkout settings under Checkout page controls. Then, once you’ve enabled Apple Pay, your customers will see the Apple Pay option when checking out with an iOS mobile device.

This connects to their Apple Pay account and will automatically pull information to complete the checkout process. The customer will see the Apple Pay overlay and select checkout information from there.

Keep in mind that Apple Pay doesn’t have an area for inputting discount codes, so to use those, your customers will need to switch to a different credit card in the customer portal. If your checkout has a custom domain, you’ll need to authorize it within your Stripe account as well.

Click here for more details and frequently asked questions.

Results & impact of Apple Pay

Apple Pay adoption has increased dramatically in recent years with more than 60% of all U.S. retailers now supporting it as a payment option. Transaction volumes have tripled year-over-year, and Statista data shows that as of 2017, there were more than 127 million Apple Pay users worldwide.

As shoppers become more mobile-centric, digital wallets like Apple Pay help accommodate buyer preferences and make shopping faster, simpler, and even more secure. Some data even indicates that by 2030, shoppers believe digital wallets will be the primary source of payments.

So what does this tell us?

Introducing a digital payment tool like Apple Pay is a smart idea for subscription merchants who want to:

- Offer shoppers a simpler, faster, safer way to pay (in fewer clicks)

- Accommodate buyer preferences and mobile shopping habits

- Reduce cart abandonment through a checkout workflow with less friction

Sounds good, right?

Introduce Apple Pay with Recharge today.