In the spring of 2021 Apple released iOS 14.5 which updated its privacy tracking and immediately affected the digital marketing landscape. Meta (Facebook and Instagram) and other ad platform algorithms became less powerful as they no longer could rely on app usage data from the majority of users to best target potential customers.

The impact on these advertising platforms was seismic with Meta, Twitter, Snap and Youtube losing nearly $10 billion after the iOS 14.5 privacy changes. That’s the macro view, zooming in on the micro, we see individual stores and brands who relied on these platforms to reach their customers hurt by the privacy changes as well.

To add to the difficulty, in late January of 2021 Meta changed their Facebook Ads Manager attribution windows from 28 days to 7 days (which may decrease your number of reported conversions with the default window formerly being four times as long). The iOS 14.5 update also causes up to 3 day delays between conversions and Facebook reporting the data.

The long short—it has not been an easy 2021 for paid social digital marketing. As a result, we wanted to explore the ways in which brands can push past these hurdles with the help of our friend Ajay Sridhar CEO at SelfMade. Ajay, take it away…

What do the iOS 14.5 privacy changes mean for my business?

This isn’t a death knell for brands, and many brands are flourishing, but if iOS changes have made your growth unsustainable, your strategy needs to change – while there are a number of things brands can and should be doing (channel diversification, more rapid creative testing, re-thinking data architecture), there is no single magic bullet to growing your brand. It is a combination of actions you can take to refine your strategy and get your brand growing again.

All of these things are great but you’ve probably read about all the tips and tricks by now—so we want to focus on a single truth related to how you should think about your brand—and from there, understand: how does this affect your sense of priorities?

For the purpose of this article—we’ll focus on the impact of your customer retention and why it’s important to accomplish two things.

- Get customers to buy more times from you

- Get customers to buy more from you, faster

It’s easy to get caught up on marketing metrics—but let’s start out with a painfully obvious (but often overlooked) truth (for most brands): CPMs, ROAS, CVR aside, your goal is to make money.

That means that the amount of money that a customer is worth to you (your customer lifetime value or LTV) should be greater than the amount you spent to acquire them (your customer acquisition cost, or CAC).

Understanding your LTV

We won’t dive too much into your CAC here but let’s do a quick refresher on your LTV. Remembering that your LTV is how much your customer is worth to you, we can define it as:

- The amount of money a customer spends each time they order on average (Average Order Value or AOV)

- The amount of money that you make on each of their orders (in most cases, your Gross Margin)

- The number of times that they purchase from you on average over a given time period

If you multiply all three of these numbers together, you get your LTV, or how much a customer is worth to your business (on average). Naturally, if you’re able to improve any one of these metrics for your brand, it will increase your LTV.

As partners, we at SelfMade and Recharge both pride ourselves on helping brands turn transactions into relationships and support brands in increasing their LTV so we’ll focus on the case to be made for making your customer retention a priority.

Serving up an example – Fiona’s Fizz

To illustrate our point, we’ll use fictional ecommerce soda business Fiona’s Fizz as an example.

Owner, Fiona, has struggled after iOS 14.5 changes. Her paid acquisition performance has declined and she’s now at a crossroads with her business. Her CAC has increased and now her LTV is barely higher than her CAC.

You might think that’s still okay, right? Well, maybe let’s look at some of her numbers.

- Average Order Value (AOV): $40

- Gross Margin: 75%

- Number of Orders per Customer: 1.5 purchases over a 1 year period

Multiplying all of these numbers together, that means Fiona’s 12-month LTV is $45

Her Customer Acquisition Cost (CAC): $40

This means that her customers on average are worth $45 to her and she is paying $40 to acquire them. She is making $5 for every new customer that she acquires over a 12 month-period.

While she’s not making a lot of money per customer, she is still making money so why is this an existential threat to her business? From a retention standpoint, we would obviously love to increase the average number of purchases per customer.

While this return isn’t enough for Fiona to be excited—it’s not the only problem here, nor is it the most severe. The other challenge is a little bit more nuanced, she doesn’t have the cash to keep investing in Paid Ads.

Here’s why. In this example, Fiona’s customers buy from her on average 1.5 times over a 12 month period. Some people may be twice, or some even 3+ times.

But say on average, for those that buy two times, it takes 5 months for them to complete their second purchase. What does this look like for Fiona? Let’s look at a timeline…

- Day 1: Fiona spends enough money to acquire a customer

- Day 2: Customer makes their first purchase

So breaking it down by spend, in two days Fiona has spent $40 to acquire 1 customer and has made $30 ($40 AOV x 75% Gross Margin)

That means that she has lost $10 in the first month on that customer.

Now let’s look at this 5 months later when that customer comes back and makes another purchase:

- Fiona has still spent $40 to acquire that customer

- Fiona has now made $60 in total ($30 from the first purchase + $30 from the second purchase)

Fiona has now made $20 on this customer (great!) but it took her 5 months to pay herself back for the money she already spent to acquire that customer. Fiona has invested her own savings into starting her business—how is she supposed to keep growing her business, and do everything else needed to grow a successful ecommerce business when she is losing money for the first 5 months on every customer she acquires?

Fiona needs to get paid back faster for the money she is spending on advertising. The faster she gets paid back, the more she is able to reinvest back into growing her business.

Solutions for Fiona

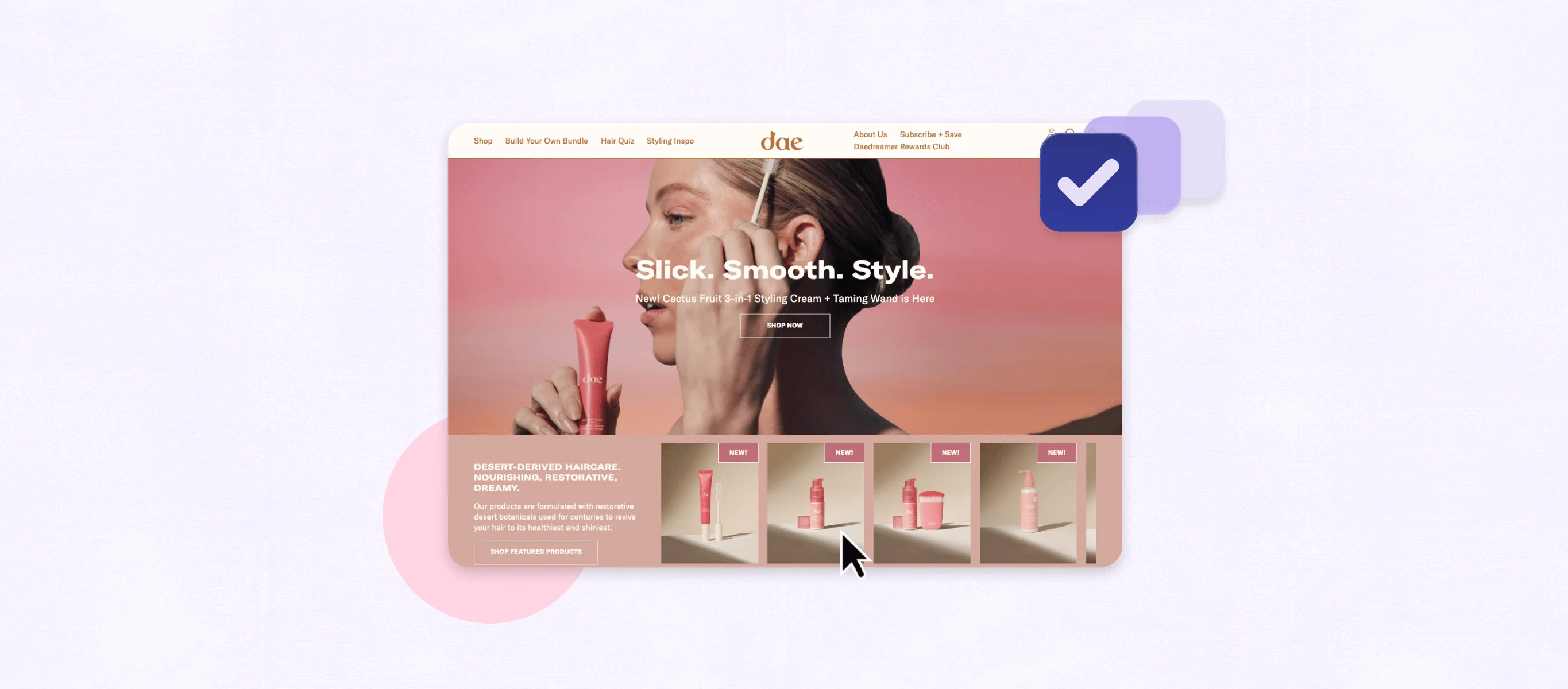

So how can Fiona get customers to purchase more frequently and help her bottom line? Adding a subscription program to her store is one of the best ways to accomplish these goals.

Merchants with subscription programs see the benefits of recurring revenue month after month as well as direct lines of communication to their customers to boost brand loyalty. By engaging with their subscribers (through transactional SMS, email or their customer portal) merchants can see an overall increase in customer lifetime value by 15-32%. Subscriptions also tend to result in higher AOV for customers as they are presented with cross-sell and upsell opportunities.

So how could Fiona get started with subscriptions? She could begin by offering Fiona Fizz’s most popular soda by subscription and letting her most loyal customers (those with the most repeat orders) know they can now get the tasty beverage on a regular basis.

The key here is letting them know of the value prompts of subscription. For Fiona’s customers it’s the convenience of getting their favorite soda regularly on a delivery schedule of their choosing (customers love having flexibility over their subscriptions) as well as perhaps incentivizing first-time subscribers with discounts.

Make sure you’re not coming off like you’re forcing your subscription program onto your subscribers. Remember customers want flexibility over their purchases. Start by reaching out to repeat customers and letting them know about your subscription program and its benefits.

These loyal customers will likely jump at the chance of receiving your products on subscription.

For those one-time purchase customers, create an email or SMS campaign drip with automations to let them know about your subscription program when you expect them to be running low on your products.

With Recharge powering your subscriptions, that data crunch felt after the iOS 14.5 privacy changes can be remedied by utilizing the subscriber data in your analytics suite. You have access to in-depth sales breakdowns, total refunds, average order values, churn rates and provide assistance projecting future revenue based on historicals.

Subscription programs allow you to understand your customers with amazing accuracy to predict and meet their needs. Recharge tells you why your customers cancelled, how much of your churn is due to failed charges, how many of your customers are skipping deliveries, or how many are swapping for other products. Inside Recharge’s product analytics dashboard you have access to which products are selling, which aren’t, the ones with highest retention as well as highest churn.

All of these data points will allow you to shift your focus with actionable insights to prioritize retention just as much as acquisition. Doing so will pay dividends to your bottom line.

If you’re looking for help with your marketing, check out SelfMade to unblock your marketing team with growth oriented solutions and top-notch creative. If you’re interested in subscriptions, start for free with the subscription payments solution trusted by over 45 million subscribers across the world.