Recurring payments and recurring billing are the cornerstones of the ecommerce subscription business model.

For customers, the ability to input their check out details one time for a recurring shipment is extremely convenient and beneficial. You have probably been prompted for a credit card at checkout than had to track down where your wallet or purse is hiding.

From the merchant side of things, think about how many people abandoned checkouts are avoided because a customer vaults their payment information with your store. Merchants also gain the tremendous benefits of recurring payments, like predictable revenue and inventory planning, multiple touch points to build rapport and brand loyalty with consumers and a higher average order value (33% on average)

Consumer readiness for recurring payments

Consumers have been familiar with the concept of recurring payments since long before the internet. For decades, Magazine subscriptions and weekly newspaper deliveries have habitually shown consumers that they can be charged at a regular interval and receive products and/or services on a recurring basis.

Then with the advent of the internet and the boom of ecommerce merchants, consumers, especially those in the Millennial and Gen Z demographics, have grown very comfortable with recurring payments. When the value of a product or service is clearly demonstrated, for example, a $8-a-month Netflix subscription, the barrier to entry is quite low and adoption can spread quickly.

The convenience factor of a recurring payment

Automated recurring payments allow customers to “set it and forget it.” And then with regular reminders of their upcoming shipments or credit card billing, customers stay informed and in control of their subscriptions without having to go through the checkout process every time.

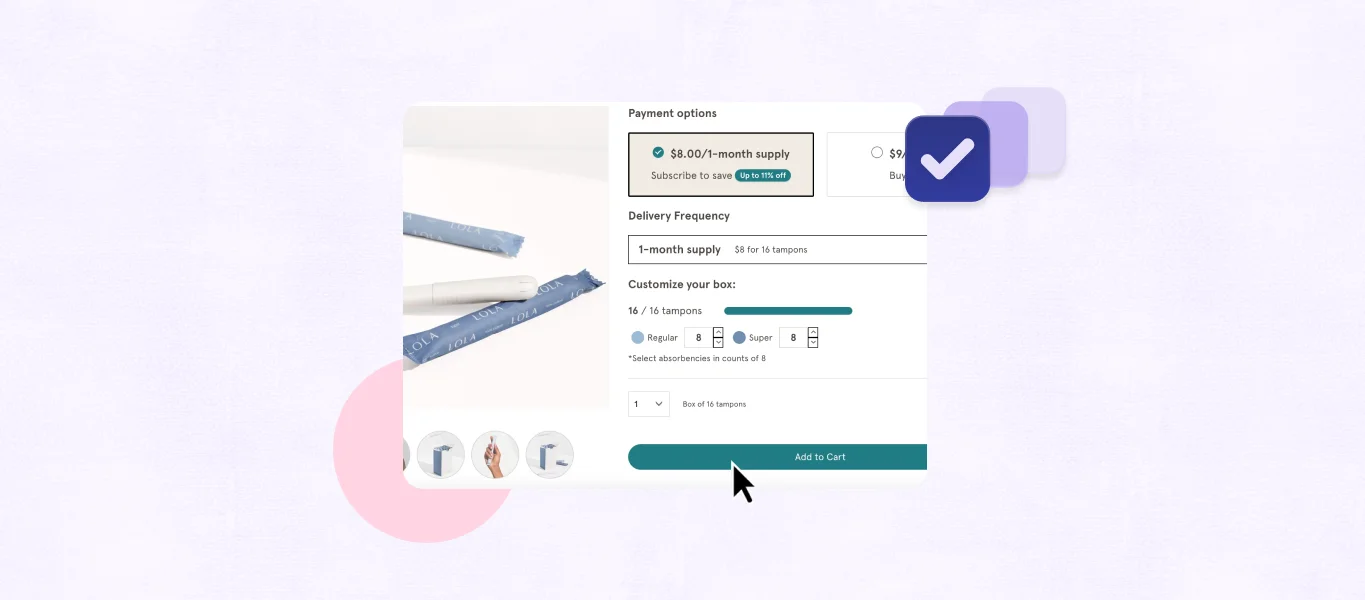

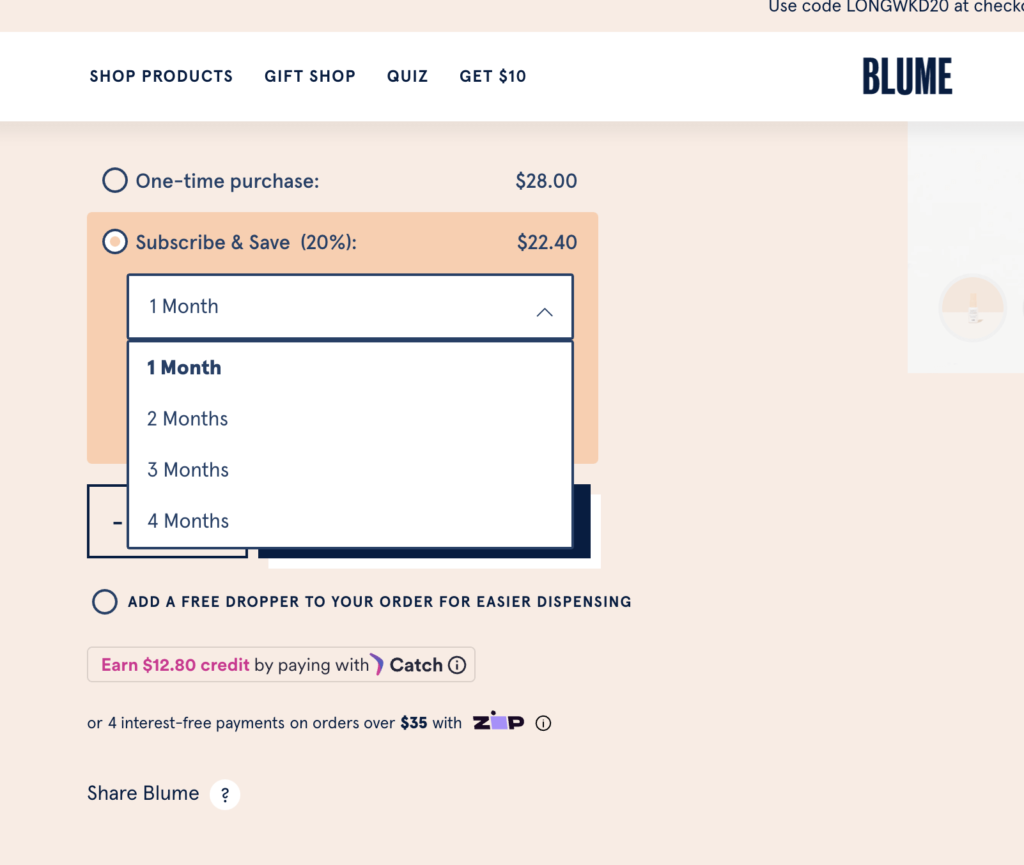

With monthly subscription boxes, products are delivered directly to the doorstep of a customer, creating the long-term relationship many companies strive for. Offering options like various regular intervals to receive a shipment, or one time purchases give customers the flexibility and autonomy to customize the payment schedule. A good example of this functionality is in Blume’s product checkout. They allow their customers to choose to purchase a one time product, or to save on a subscription and choose their payment schedule.

As with any business model, customers may eventually cancel. Active churn, where customers choose to cancel for various reasons within their control, can occasionally be presented as options to reactivate the subscription. However passive churn, or dunning, can occur when there’s an issue such as insufficient funds in their bank account, or billing errors. Having recurring billing automated allows you to notify customers when there has been an issue so they can remedy the situation.

Recurring payments work for customers because they are tailored to provide them with the most convenient experience possible. By allowing subscribers to feel empowered in their purchases, you give them the control they crave while also maintaining a regular payment schedule.

What are the types of recurring payments?

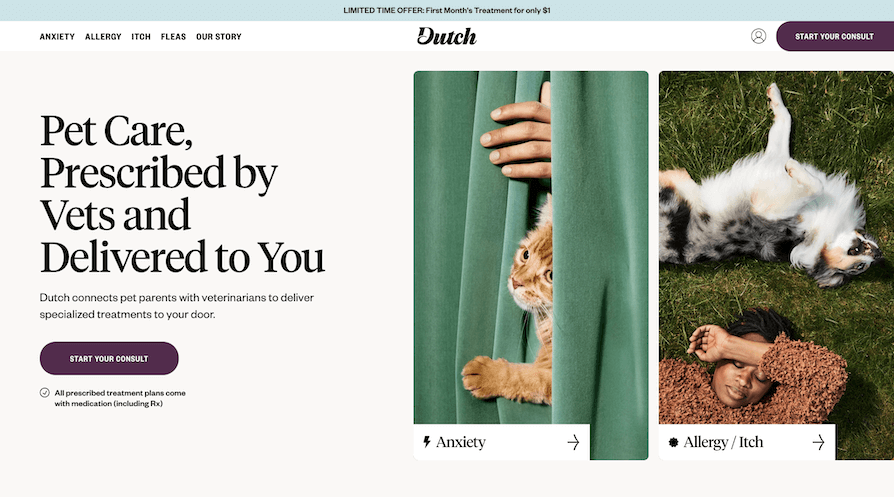

There are two main types of recurring payments, fixed and variable. Fixed recurring payments are repeatable amounts that do not change regardless of the services rendered that month. A great example of this is Dutch, a pet care company that specializes in televisits and prescriptions for a fixed monthly payment. As part of their customers’ monthly membership fee, they provide all services and medication for the pet, regardless of changes to their needs.

Variable payments are those that can ebb and flow with the changing needs of the customer. An example of a variable recurring payment is typically in a usage-based environment, like SaaS tools or in web-based applications. These payments shift depending on what the user or customer consumes in a given timeframe.

Merchant benefits to recurring billing

Consumers are typically very comfortable with the concept of recurring billing, and merchants benefit significantly from a subscription type business model. Recurring billing allows for merchants to have advanced knowledge of how much revenue they will be bringing in in a given period of time, which allows for future planning. The predictability of incoming revenue can take the pressure off of acquiring new customers, and instead shift the focus to retaining existing customers.

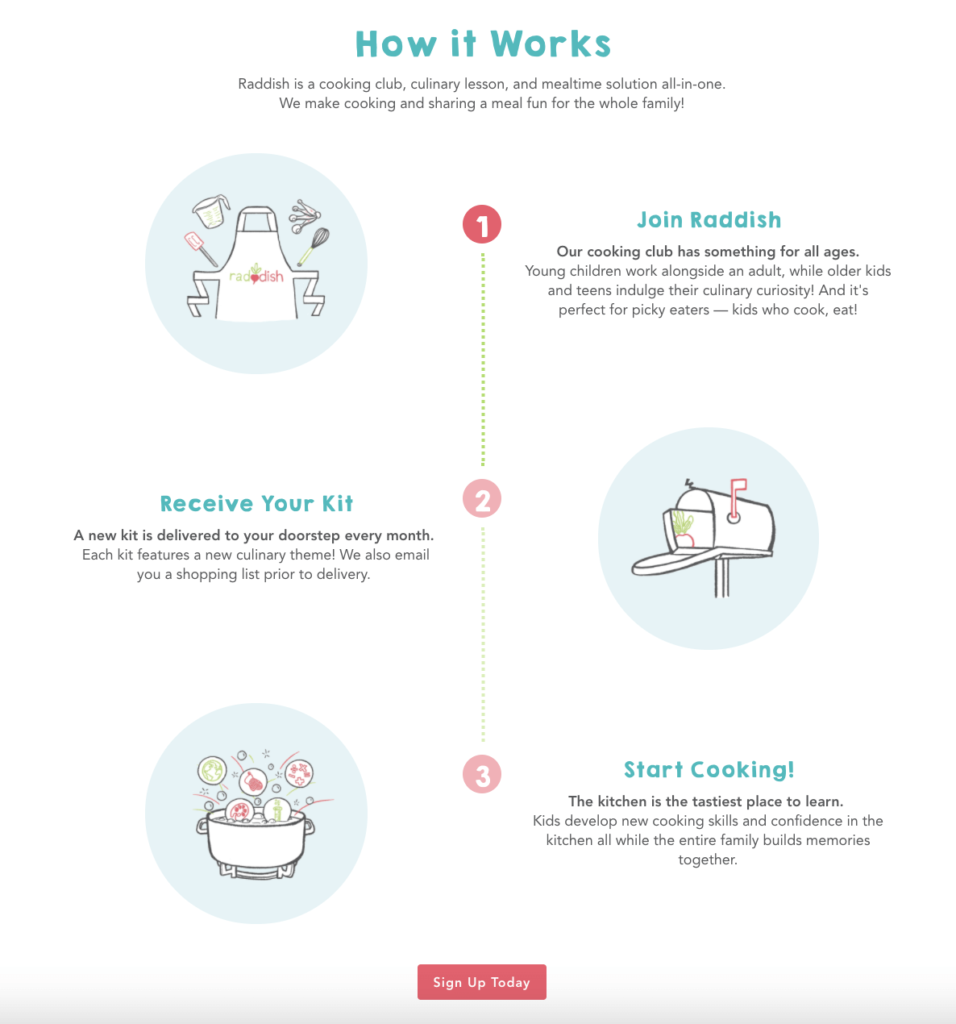

The billing cycle should be when outlined clearly for customers and remain consistent. An example of the clear communications needed is Raddish, a cooking club designed for kids. They explain the entire subscription process on their website, from what the customer needs to do, and what they will receive.

Subscription payments as a recurring payment option

Often, recurring billing and subscription services are synonymous. Subscription box services provide goods at regular intervals for a recurring payment. A customer’s account is automatically charged and they typically receive a small monthly discount as a value to their subscription.

For merchants exploring a subscription business model, it’s imperative to accept payments via automatic billing. That being said, providing your customers with regular updates about their transactions—whether by transactional SMS, the customer portal, or via email— empowers them to stay on top of their subscriptions. In doing so, you can increase their lifetime value from 15% to 32% just by increasing engagement! Additionally, a customer who is involved in their purchases every month is less likely to experience both active and passive churn. This level of communication is a huge opportunity for customer retention and results in fewer missed payments.

Subscription billing also requires an appropriate payment processor, one that can automatically charge customers for the goods or services they are receiving. For example, Recharge accepts automatic payments during the checkout process for both credit and debit cards. A customer’s payment information only needs to be entered once, during the initial purchase, making it highly convenient for them.

As illustrated with the Blume example, subscriptions can have various intervals that work within a customer’s needs, whether on a monthly basis, yearly intervals, or somewhere in between. Many subscriptions also result in cost savings for the customer,

Payment details for subscription payments

Whether you choose fixed or variable payment terms for your subscription service will likely depend on the type of subscription business model you choose.

Access, or membership based, businesses are those that charge customers a monthly or yearly fee in return for special benefits. Many connected fitness brands choose this route, as exercise equipment is typically a one-time purchase. Customers are instead paying for access to things like specialized content or classes.

Replenishment businesses became ever popular during the pandemic, in that they act as a refill of commonly used products. Often found in household items like laundry detergent or toilet paper, replenishment subscription brands have done the research to understand exactly when a customer is about to run out of their product, only to have a new shipment arriving to their doorstep.

Curation businesses, the most popular subscription model, are often used in specialty boxes. From fashion and apparel to beauty brands, curated subscription boxes focus on the “surprise and delight” factor with their customers. They create an experience that keeps customers coming back, in hopes they’ll get to try something new.

The payments accepted for these 3 types of subscriptions are generally the same, utilizing a checkout that allows customers to choose to subscribe to a particular product. The details of the payments for consumers can live on a dedicated subscription landing page, linked right from the checkout page. This gives new subscribers the information they need to make an informed decision about whether or not to subscribe to your brand’s goods or services.

How do I accept a recurring payment?

It’s imperative to find an application to help automate the recurring billing for your brand so you can reap the benefits of having predictable revenue. You can think of an application like this as a recurring payment system, one that allows for a seamless checkout process for your subscribers, without having to reinvent the wheel. So how do you accept regular payments for the goods and services you offer?

Implementing a subscription payments solution like Recharge takes the majority of the guesswork out of setting up a subscription focused checkout and instead lets you focus on building strong relationships with your subscribers. These solutions are designed to simplify the complex in a recurring payment model.