As we entered a new decade, any expectations for the new roaring twenties were flipped on their head when the COVID-19 pandemic swept across the globe. Our pre-existing assumptions toward ecommerce needed to be reevaluated as businesses everywhere were disrupted and changed by our new normals.

Spending patterns became unpredictable as consumer behaviors shifted overnight. Customer acquisition costs fluctuated greatly as marketing budgets were paused, cut, accelerated, and everything in between. Is there any sense to be made of the last six months?

ChargeX 2020 on September 2-3 will examine these very issues impacting the ecommerce landscape. We don’t claim to have a crystal ball, but gathering top minds in the subscription space is a great place to start.

Looking back to see forward

As historian Yuval Noah Harari once wrote: “[Crises] fast-forward historical processes.” While Harari referred more to societal, political, and cultural change, there is another important angle — business. As we are seeing now, in the midst of the COVID-19 pandemic and the economic turmoil it has created, whole industries can appear, disappear, and pivot overnight when faced with extreme events.

Indeed, few events advance technology, business models, and corporate strategy at the rate of crises.

For instance, in the aftermath of the Great Recession, entrepreneurship often seemed like the only way forward. Millions of people had lost their jobs and few companies were hiring—but there was a surprising spike in innovation. Take Lehman Brothers, the largest corporate casualty of the crash. Overnight, tens of thousands of the bank’s white-collar workers found themselves unemployed. While some moved into other corporate roles, many struck out on their own.

Scores of fintech startups including the challenger bank Revolut and the investment firm MarketFinance all have former Lehman employees at the helm. But not every laid off employee-turned-entrepreneur stuck within their familiar financial sphere. Some looked beyond the world they knew and launched exciting businesses in retail, fashion, and hospitality.

Adam Taylor, who cut his teeth in Lehman’s mergers and acquisitions division, pivoted to pet supplies, launching PetShop. Koen Thijssen, an industrials analyst, launched Bloomon, a flower subscription service. And John Candillier, who headed up the bank’s European equities unit, created the mobile tagging platform Tag My Phone.

Most of these businesses simply couldn’t have existed before the financial collapse, according to Diane Albouy, CTO of smol. Back in the early 2000s, Taylor, Thijssen, and Candillier would have needed significant financial backing to develop their technologies from scratch. But by 2008, there were readymade platforms and products waiting on the shelves.

“Platforms like Recharge and Shopify allowed for anybody to start a business,” explains Albouy, who worked at Goldman Sachs as a technology analyst during the crisis. “If you had an idea, you could just go and try it. Up until then, you had to know that your idea was going to work.”

That newfound freedom, combined with the financial crisis throwing millions of the brightest minds out of work, accelerated business development.

“Society and the future both looked very different,” Albouy says. “That changed people’s perspective, ideas, and willingness to try new things.”

The receptive environment meant entrepreneurs could experiment not just with their products and services but with the underlying business models, too. One of the burgeoning strategies to emerge was direct-to-consumer (D2C) — an ecommerce business model where manufacturers sell directly to consumers without a middleman.

In the years after the crisis, D2C companies flooded the market.

“It’s like any marketplace,” Albouy says. “Supply shot up all of a sudden because people lost their white-collar corporate jobs and started new businesses. From the demand perspective, it’s been super interesting to see demand growing.”

Sustainable clothing brand Reformation launched in 2009. Glasses retailer Warby Parker and modern basics brands Everlane arrived in 2010. Direct-to-consumer posterchild Dollar Shave Club appeared in 2011.

Little did we know that this was just the start of the story. A dozen years later, another crisis, the COVID-19 pandemic, was waiting to revolutionize the D2C sector once more.

Worldwide digital transformation

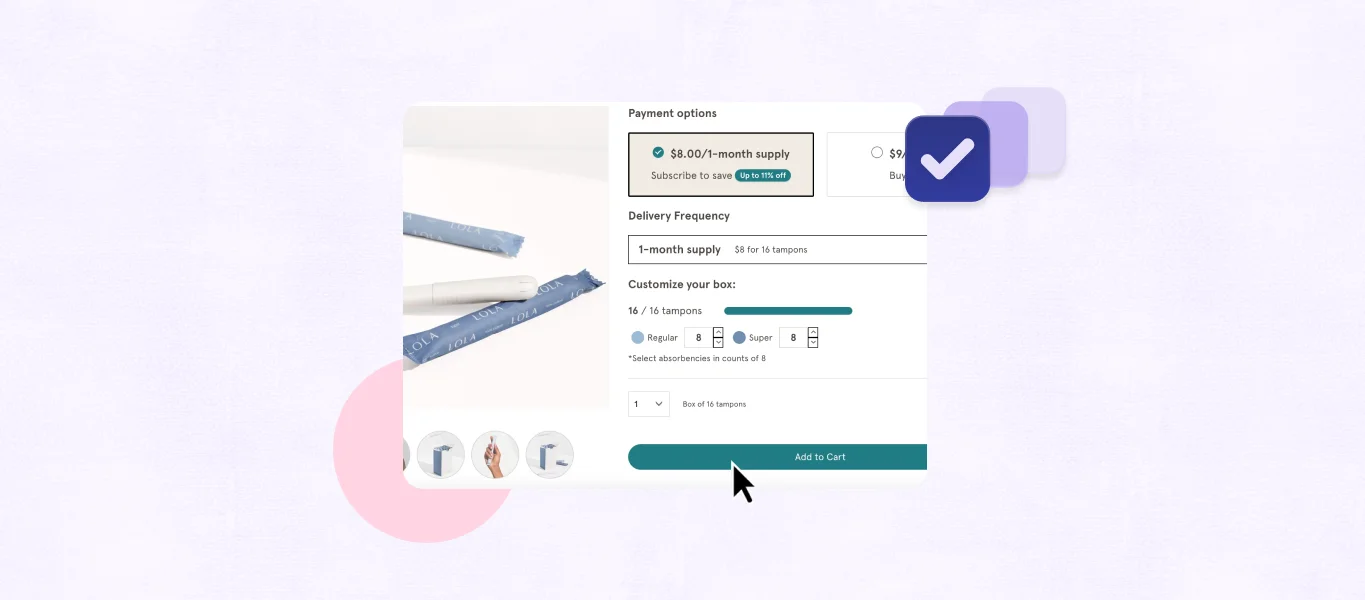

Even as society returned to normality and stability following the financial crash, D2C businesses didn’t disappear. Indeed, since 2008 D2C brands have gone from strength to strength. Consider one small part of the market—subscriptions. As recently as 2011, subscription-based businesses generated $57 million in sales. Today, that figure is between $12 billion and $15 billion.

Yet despite significant growth and adoption, some corners of the economy have remained steadfastly reluctant to even consider it as a business model.

“There was still a big gap between the physical shop and the digital shop,” says Albouy. “Businesses were always dominant in one of them. You buy it from the shop or you’re an online buyer. There wasn’t much interchanging.”

But the recent COVID-19 pandemic has blurred that distinction. Almost all restaurants are now offering online ordering, mom and pop convenience stores have rolled out click and collect orders, and many businesses are working from home as standard. Importantly, these transformations have rarely affected the customer experience.

“The guy who has a shop around the corner who is all about the communication with his customer discovered that having an online presence doesn’t change this,” says Albouy. “He still controls his image and he still controls his brand.”

The pandemic acted as a compulsory experiment in digital transformation, shepherding technology laggards towards a digital future. The world has leapt forward a decade in just a few months, transforming businesses and how we interact with them. As the last few holdouts give in and adopt D2C technology, the rate of change is likely to increase even further.

Press fast-forward

Back in 2008, the Great Recession created an entrepreneurial revolution and set the stage for the D2C economy. In 2020, the COVID-19 pandemic accelerated things once more, making digital interactions the norm and establishing D2C as the default for many organizations.

Reflecting on how far the D2C economy has come in so few years, Albouy is philosophical. Rather than the conclusion to a worldwide process of transformation, she sees the recent changes as the start of a larger journey. And although she can’t see the destination just yet, she’s excited to see what the future holds.

“The D2C space is going to get more and more exciting as technologies open up, not just from an ecommerce and operational perspective, but also from a marketing perspective,” she says. “You can just apply it to pretty much all of the verticals of D2C. “The space has evolved a lot, but there is also so much room for new businesses.”

How much room exactly is there for new businesses? What can existing brands do to successfully pivot and continue scaling? Join us at ChargeX 2020 on September 2-3 as we continue to dissect the ever-changing ecommerce landscape.