The subscription industry has seen monumental growth in recent years, with merchants of all sizes and product verticals flocking to the business model. Integral to these offerings are recurring orders.

In a recurring order, a purchase is set up to repeat automatically. Customers then receive their orders (or are charged for an ongoing service) on a set schedule rather than having to complete a one-time purchase again and again.

So—why are recurring payments so popular for merchants? Businesses can use this model to improve cash flow, establish closer customer relationships, and create steady growth. But the proper software infrastructure is necessary to ensure a seamless customer and merchant experience.

Read on to learn more about how recurring orders work, and how you can leverage them for your ecommerce business.

Key takeaways

- Recurring orders are purchases that repeat automatically on a set schedule. They often occur as part of a subscription service.

- Recurring orders can be beneficial for businesses in a number of ways, from improving cash flow and creating predictable growth to building customer loyalty.

- To leverage this model, ecommerce businesses must first set up the right software infrastructure.

Benefits of recurring orders

When set up properly, recurring orders can deliver an exceptional customer experience while improving your profits.

Let’s dig deeper into the benefits of this ecommerce and payment processing model.

Improved cash flow

Many experts recommend maintaining a 6-month cash flow projection, so your business can adequately prepare for the future. Subscriptions can help make this goal more attainable by making forecasting more predictable. You’ll know just how much each subscription customer orders and when you’ll bill them for their next purchase.

Boosted customer loyalty

By automating the payment and billing process, recurring orders have a significant convenience factor for both merchants and consumers. In the long term, this better customer experience can allow you to deepen your subscriber relationships.

If you provide excellent services and customers learn they can trust you with their ongoing business, they may be more likely to think of you as a go-to provider when it’s time to shop for similar products.

More predictable growth

With a steady income fueled by long-term customer relationships, reliable growth is easier to both develop and project with recurring orders.

How recurring orders & payments work

Automation makes recurring orders efficient and effective. You’ll need to choose the right infrastructure that can support these orders. Without it, you won’t deliver the experience your customers expect.

You’ll need three basic elements:

- An ecommerce site: You must tell customers about your products and services and entice them to subscribe.

- A subscription solution: From there, you’ll need a software provider that can allow you to accept customer orders and set up recurring charges.

- A payment gateway: This software accepts various payment methods, including those done via credit card, debit card, PayPal, and more.

With those pieces in place, you can start accepting recurring orders. These are typical steps involved:

1. A customer chooses a recurring payment option

Once they know the product or service they want (and will want again soon), they opt to sign up for recurring orders. Here, they’ll select the quantity and frequency of their recurring purchases.

2. That customer agrees to terms & conditions

Once customers enter payment information (which is typically credit card information), a window appears, providing a legal description of the agreement the customer is entering with you.

Your terms and conditions could specify the following things:

- Amounts: How much will your customer be charged for the orders? If your customers pay for shipping, those costs should be included, along with any associated fees.

- Schedule: When will the money leave your customer’s account and come to you? People with tight schedules tied to paychecks appreciate detailed deadlines.

- Length: How long will your agreement last, and will it renew automatically?

Your customer should both read these details and agree to them before any money changes hands.

3. Your payment processor facilitates the fund transfer

With the agreement in place, you can now accept data and set your payment processor to work.

They will do the following:

- Contact the customer’s funding source (credit card company, bank, etc.)

- Specify the transfer amount

- Transfer those funds to the merchant’s account

- Repeat for the duration of the agreement

Be sure to notify your customers each time you’ve sent out a recurring order, so they always know when money is moving.

Grow your ecommerce business with recurring orders

Depending on the products and services that you offer, recurring orders can provide your ecommerce business with a steady and reliable income source, as well as an exceptional customer experience. This model not only helps turn one-time buyers into repeat customers—it can also help generate real brand loyalty.

FAQs on recurring orders

In recurring payments, do customers pay the same amount for each payment cycle?

Typically, subscription customers are charged the same base amount with every recurring purchase. However, this can vary from business to business.

Can all businesses benefit from a subscription model?

Not all businesses are a fit for the subscription business model—this all depends on the products and services they offer, as well as the preferences of their unique customer base. Companies best suited for subscriptions are ones that sell products that customers use on an ongoing basis (like software or streaming services), or that customers use frequently and need to replace (like snacks or cleaning supplies).

What risks come with recurring payments?

Like all online payments, recurring payments are subject to fraud. To mitigate these risks, learn about the warning signs of fraud, and be sure to build out your tech stack with partners that offer superior security and support if something goes wrong.

Sources

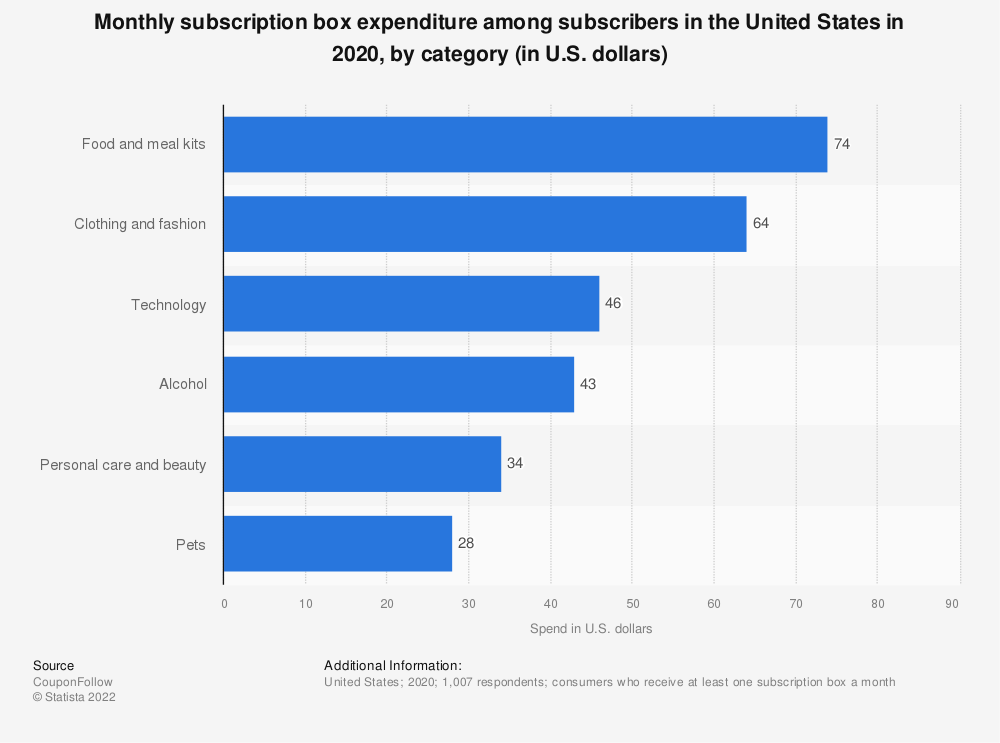

[1] Monthly Subscription Box Expenditure Among Subscribers in the United States in 2020, by Category. ((August 2022). Statista. )

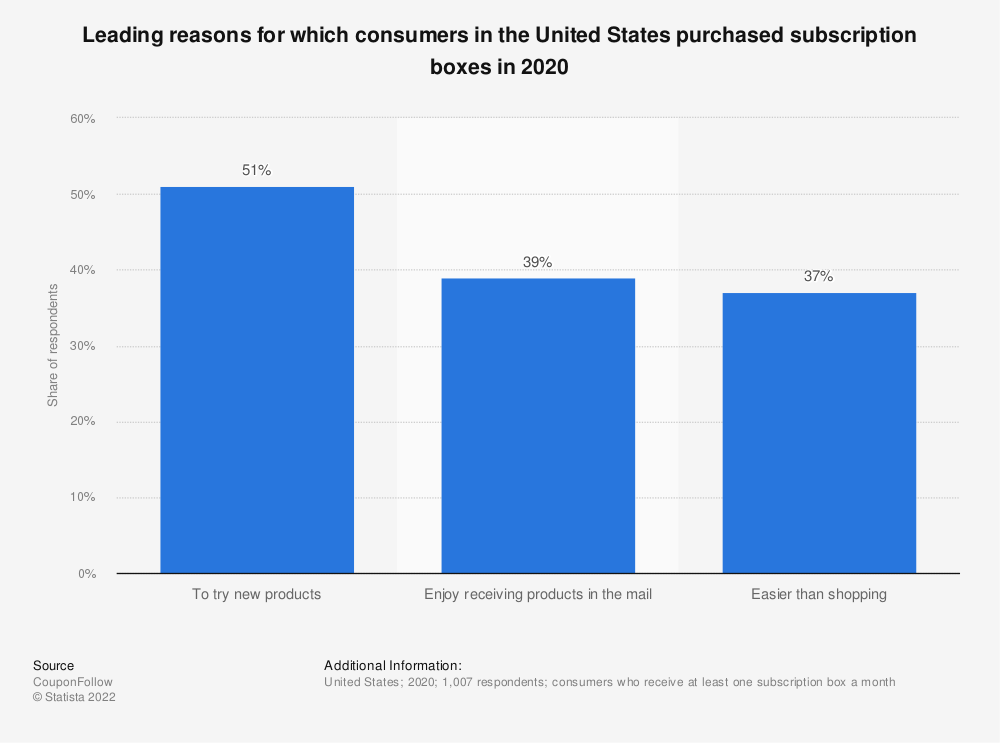

[2] Leading Reasons for Which Consumers in the United States Purchased Subscription Boxes in 2020. ((August 2022). Statista.)

[3] 4 Biggest Causes of Cash Flow Problems. ((March 2019). PNC Insights. )