Popular use cases

Keep up with rate changes

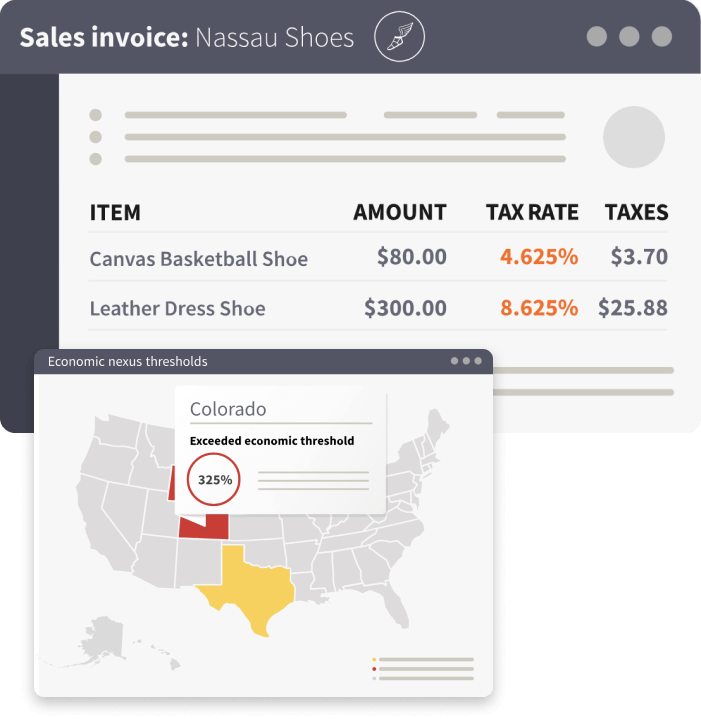

Assess rates based on geolocation, not ZIP code, so your customers are charged the right rates for their purchases.

Automatically apply differing tax rates

Calculate the right rate for a variety of circumstances, including product-specific tax rates, sales tax holidays, shipping and handling rules, and more.

Review economic nexus status across multiple states

Get alerts when you’re about to establish tax obligations in new places, based on their individual nexus laws.

Consolidate reports on sales tax liabilities and exemptions

AvaTax reports can significantly reduce the effort and time it takes to prepare returns or address auditor needs.

About Avalara

Avalara helps businesses of all sizes get tax compliance right. In partnership with leading ERP, accounting, ecommerce, and other financial management system providers, Avalara delivers automated, cloud-based compliance solutions for transaction tax, including sales and use, VAT, GST, excise, communications, lodging, and other indirect tax types. Headquartered in Seattle, Avalara has offices across the U.S. and around the world in Canada, the U.K., Belgium, Brazil, and India. More information at avalara.com.